What does AfterPay really Cost?

AfterPay make their money from two aspects of every sale.

AfterPay income from the Seller.

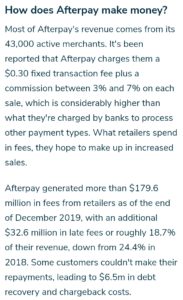

It’s been reported that Afterpay charges retailers a $0.30 fixed transaction fee plus a commission between 3% and 7% on each sale.

AfterPay Income Sources

In 2019, retailers paid $179.6 million to AfterPay.

If a retailer wants to sell something for $100, they might need to sell it for $108, as they would have to pay AfterPay up to $7.86 in commission on that $108 sale, leaving the retailer $100.14 for their sale.

AfterPay income from the Customer.

In 2019, customers paid $32.6 million in late fees to AfterPay.

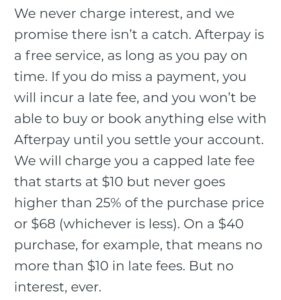

Afterpay is a free service, as long as you pay on time. If you do miss a payment, you will incur a late fee, and you won’t be able to buy or book anything else with Afterpay until you settle your account.

To avoid late fees, the customer makes an initial payment of 25% at time of purchase then 3 equal fortnightly payments, on time.

AfterPays income from customers is on late fees up to 25% of the purchase price, rather than lower interest rates. Their income from the retailer is up to an additional 7%.

Are AfterPay customers protected by loan regulations?

Afterpay does not require customers to enter into a loan or a credit facility. This means there are fewer protections for customers, compared to those who sign a regular loan agreement.

Total AfterPay Income.

Afterpay generated more than $179.6 million in fees from retailers as of the end of December 2019, with an additional $32.6 million in late fees.

Conclusion:

AfterPay, when the customer pays it off on time, without incurring late fees, only costs up to an extra 7%. (The fee paid by the retailer, and included in the selling price).

I personally prefer to use a Coles Mastercard, (No annual fee and no interest if paid on time), and pay it within the normal interest free month.

Compare AfterPay to Credit Card.

Late fees on that $108 sale, if not paid on time could be:

AfterPay at 25% flat late fees would be $27.00

Credit card at 19% p.a. would be $1.71 after one month, or $20.52 after 12 months.

All AfterPay customers already have a credit card, as it is a condition of the AfterPay agreement.

It is estimated that one in every six “buy now pay later” [BNPL] customers pays the late fees.

AfterPay users make the first payment of 25% upfront at time of purchase. They are then responsible for making the three remaining payments on time to avoid being charged late fees.

Some excerpts from choice.com.au

Afterpay puts the onus on consumers to do the sums on their ability to pay over the course of two months.

Asking for a refund within 120 days of buying a product means the retailer must reimburse Afterpay first, which in turn refunds the money back to you.

Afterpay will only process a refund following a refund request from the retailer.

I do suggest reading the following and make an informed decision before using AfterPay, or other BNPL payment plans.

https://www.choice.com.au/shopping/online-shopping/buying-online/articles/what-is-afterpay

AfterPay at No Cost

AfterPay Customer Fees