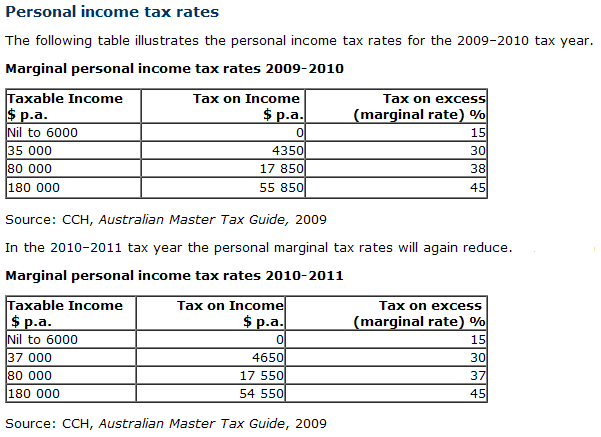

Australian Income Tax Rates for the year 2009/2010

|

Taxable income |

Tax on this income |

|

$0 ?? $6,000 |

Nil |

|

$6,001 ?? $35,000 |

15c for each $1 over $6,000 |

|

$35,001 ?? $80,000 |

$4,350 plus 30c for each $1 over $35,000 |

|

$80,001 ?? $180,000 |

$17,850 plus 38c for each $1 over $80,000 |

|

Over $180,000 |

$55,850 plus 45c for each $1 over $180,000 |

* Low income earners under $15,000 will pay no tax, due to the Low Income Tax Offset.

The above rates DO NOT include the 1.5% Medicare levy

Rates for the following year, 2010-2011, as set out in the 2009-10 budget are shown below.