NSW Property Tax or Stamp Duty option.

The NSW Government now provides first home buyers, purchasing properties for between $650k and $1.5million, the ability to choose to pay an annual property tax instead of stamp duty.

The property tax will only be payable by first home buyers who choose it, and will not apply to subsequent purchasers of a property.

To be eligible:

- you must be an individual (not a company or trust).

- you must be over 18 years old.

- you, or at least one person you’re buying with, must be an Australian citizen or permanent resident.

- you or your spouse must not have previously:

- owned or co-owned residential property in Australia.

- received a First Home Buyer Grant or duty concessions.

- The purchase price must be more than $650k and up to $1.5m.

- you must move into the property within 12 months of purchase and live in it continuously for at least 6 months.

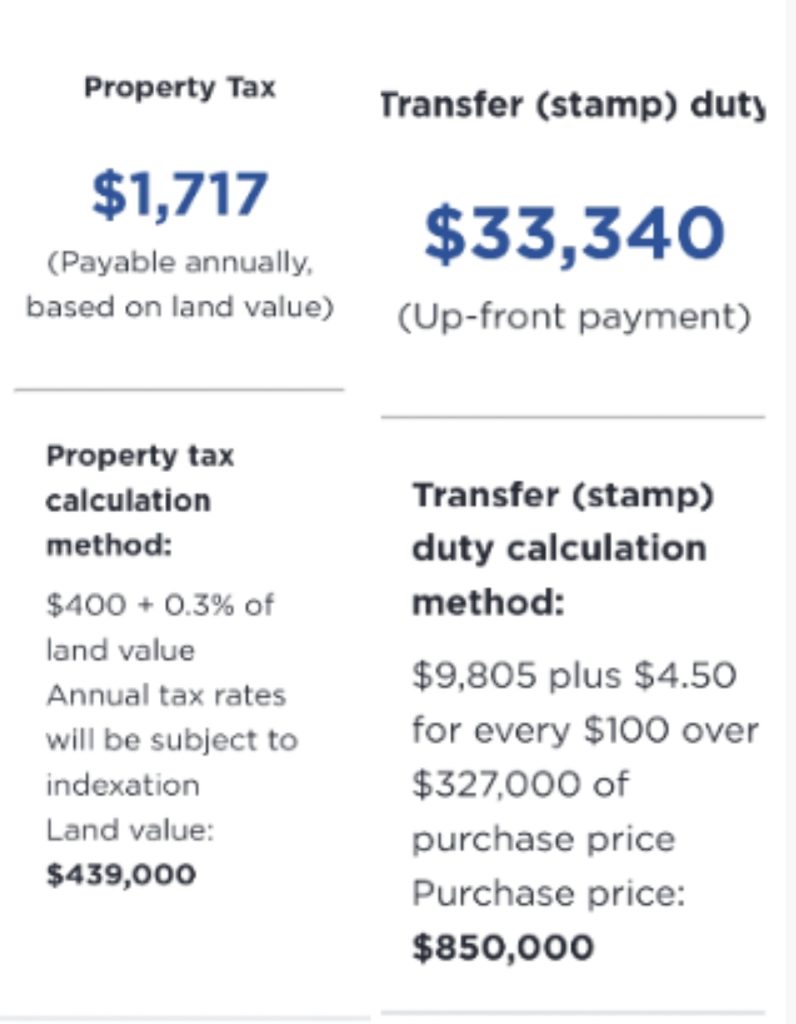

The annual property tax payments will be based on the land value of the purchased property.

The property tax rates for 2022-23 and 2023-24 will be:

- $400 plus 0.3 per cent of land value for properties whose owners live in them.

- $1,500 plus 1.1 per cent of land value for investment properties.

An example of these is shown in the images below.

Or, if the house price is less, but the land value is the same:

These tax rates will be indexed each year from 2024-25, so that the average indexed property tax payment rises in line with average annual incomes.