The Australian Aged Pension from March 2020.

The Australian Aged Pension is revised in March and September each year, and the March 2020 new Pension Rates have been released. This pension is paid Fortnightly.

The Government Aged Pension is a welfare benefit, paid by the Department of Human Services [Centrelink], the Australian welfare system.

The new, fortnightly, rates from 20th March 2020 are:

Single Person Aged Pension March 2020

$860.60 from $850.40 Single Base pension

$ 69.60 from $68.90 Pension Supplement

$ 14.10 no change from $ 14.10 Energy Supplement

$944.30 from $933.40 Total Pension

Married Person Aged Pension March 2020

$648.70 from $641.0 Married Base Pension

$ 52.50 from $51.90 Pension Supplement

$ 10.60 no change from $ 10.60 Energy Supplement

$711.80 from $703.50 Total Pension per person.

Eligibility for the Australian Aged Pension.

The Aged Pension is an Income support for older Australians, it is not something that everyone gets. It is only for those in Financial Need.

Most Australians reaching retirement age will be eligible for a Superannuation from their Employment, under the Compulsory Super Plan. This income may make them ineligible for the Aged Pension under the Income and Assets test.

To be eligible for the Aged Pension you need to fit the various Eligibility Requirements, these include:

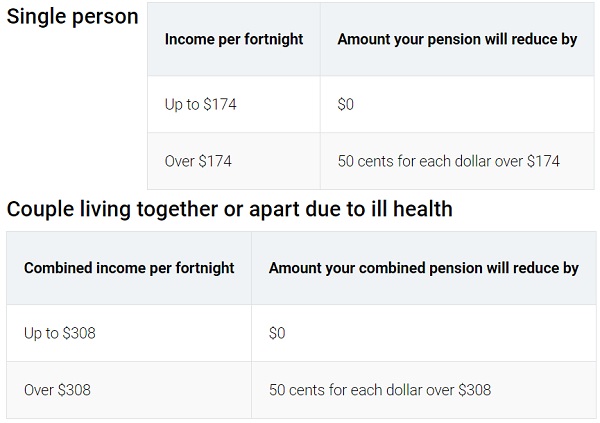

Income test.

Pension Rates are reduced where the recipient receives other income.

- A single person would lose 50 cents for each dollar over $174 of other income per fortnight.

- A member of a couple would lose 50 cents for each dollar over $308 of other income per fortnight.

The Age Pension will no longer be paid if your other income is higher than the following amounts per fortnight:

- $2,062.60 for a single person.

- $3,155.20 combined income for a couple living together.

- $4,085.20 combined income for a couple living apart due to ill health.

The cut off point will be higher if you have the Work Bonus.

Residence Requirement.

To be eligible for the aged pension, you need to be a Australian resident for a total of at least 10 years, with at least five of these years in one period.

Any eligible overseas pension must be applied for, and the rate will be taken into account when calculating the Australian Payment rate.

Age Eligibility for Aged Pension.

- Birthday Between: 1 July 1952 to 31 December 1953, Eligible at 65 years and 6 months

- Birthday Between: 1 January 1954 to 30 June 1955, Eligible at 66 years

- Birthday Between: 1 July 1955 to 31 December 1956, Eligible at 66 years and 6 months

- Birthday After: 1 January 1957, Eligible at 67 years

Assets test.

Aged Pensions reduce when your assets are more the limit for your situation.

The Assets test does NOT include your Principal Home.

From 20 March 2020, a homeowner can have assets that do not exceed the following, and receive the full age pension.

- $263,250 Single.

- $394,500 Couple, combined.

- $394,500 Couple, separated due to illness, combined.

- $394,500 Couple, 1 partner eligible, combined.

From 20 March 2020, a homeowner can have assets that do not exceed the following, and receive the full age pension

- $473,750 Single.

- $605,000 Couple, combined.

- $605,000 Couple, separated due to illness, combined.

- $605,000 Couple, 1 partner eligible, combined.

From 20 March 2020, a homeowner with assets that do not exceed the following, will receive a part pension.

- $578,250.00 Single

- $869,500.00 Couple, combined

- $1,024,500.00 Couple, separated due to illness, combined

- $869,500.00 Couple, 1 partner eligible, combined

From 20 March 2020, a Non-homeowner with assets that do not exceed the following, will receive a part pension.

- $788,750.00 Single

- $1,080,000.00 Couple, combined

- $1,235,000.00 Couple, separated due to illness, combined

- $1,080,000.00 Couple, 1 partner eligible, combined

The Age Pension will normally cease when Other Incomes exceed those limits.

Australian Aged Pension Payment Rates.

- Age Pension Increase March 2024. 9th February 2024

- Australian Aged Pension from September 2023 4th September 2023

- Australian Aged Pension from March 2023 6th March 2023

- Australian Aged Pension from September 2022 5th September 2022

- Fake News: $4,000 for Retirees 4th September 2022

- Australian Aged Pension from March 2022 13th March 2022

- Australian Age Pension while outside Australia 14th September 2021

- Australian Aged Pension from September 2021 13th September 2021

- Australian Aged Pension and Work Bonus 7th August 2021

- Australian Aged Pension from March 2021 12th March 2021

- Australian Aged Pension from September 2019 17th September 2019

- Australian Age Pensioner Updates April 2019 5th April 2019

- Australian Aged Pension from March 2019 24th March 2019

- Australian Aged Pension from September 2018 10th September 2018

- Pension Age in Australia 6th September 2018

- Australian Aged Pension – Non-resident Citizen of Australia 9th August 2018

- Australian Aged Pension from March 2018 1st March 2018

- $3.05 per week Increase in Australian Aged Pension from Sept 2017 14th September 2017

- Aged Pension Rates in Australia 2017 14th September 2017

- Australian Aged Pension and Living Overseas 19th October 2015

- Aged Pension in Australia 23rd August 2015

Previous Total Aged Pension Rates

Married Person (each) Total Fortnightly Pension rates

Mar 2020 $ 711.80

Sep 2019 $703.50

Mar 2019 $698.10

Sep 2018 $690.70

Mar 2018 $684.10

Sep 2017 $674.20

Mar 2017 $669.60

Sep 2016 $661.20

Mar 2016 $658.70

Single Person Total Fortnightly Pension rates

Mar 2020 $944.30

Sep 2019 $933.40

Mar 2019 $926.20

Sep 2018 $916.30

Mar 2018 $907.60

Sep 2017 $894.40

Mar 2017 $888.30

Sep 2016 $877.10

Mar 2016 $873.90

Sources:

From 1 February 2020, the Department of Human Services became Services Australia.

Services Australia is responsible for the delivery of advice and high-quality, accessible social, health and child support services and payments. We deliver a range of health, social and welfare payments and services through Medicare, Centrelink, and Child Support.

servicesaustralia.gov.au/news/we-are-now-services-australia