Key points to the Australian Federal Budget 2014.

Why ?

Without action we face a decade of deficits and debt growing to $667 billion by 2023-24. This equates to $23,000 for every person in Australia, and would see the Government spending more on interest than on aged care by 2023-24.

What?

- Low income single parents will be assisted with a new allowance of $750 per annum for each child aged 6 to 12.

- The School Kids Bonus is still under legislation for being axed after the 2013 announcement. more…

- Pensions will be indexed to the CPI, rather than wages, from September 2017.

- A $7 payment to see the doctor. From 1 July 2015, previously bulk-billed patients can expect to contribute $7 per visit towards the cost of standard GP consultations.

- Youth Allowance will no longer be paid if you’re overseas while you’re studying.

- The large family supplement on Family Tax Benefits, will be changed to start at FOUR children, not Three.

- Mature Age Employee wage subsidy

- From 1 July 2014, employers who hire an eligible mature-aged job seeker, on a full-time basis, will be paid a subsidy of $10,000 over 24 months. Employers that hire mature-aged job seekers on a part-time basis (12-29 hours per week) will be eligible for a pro-rated subsidy based on actual hours worked.

- Temporary Budget Repair Levy 2% on earnings over $180,000 pa

- From 1 July 2014 until 30 June 2017, the Temporary Budget Repair Levy will be payable by individuals whose taxable income exceeds $180,000 at a rate of two per cent. BUT, ONLY on the income above $180,000 per year. ie: earn 180,001 and you pay 2% on just that $1.. Earn $200,000 and you will pay two per cent of $20,000 (ie: $200,000 less $180,000), ie: You pay $400 extra if you earn $200,000 per year. more..

- The arts community in Australia loses $97.1 million in funding over four years.

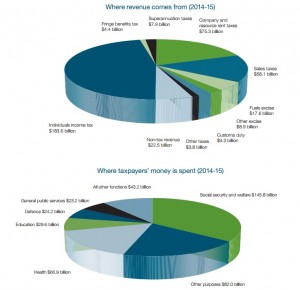

Where the money comes from and where it goes:

Budget Overview: http://www.budget.gov.au/2014-15/content/overview/html/index.htm